This article’s title caught my eye via my magical Google Alerts that I review every morning. This article was titled “Spinal Implants Market is Expected to Reach $14.3 Billion” by Yahoo Finance. [1] If you are familiar with market reports, you know those guys aren’t cheap. Not all of us have companies with monetary resources to allocate so that everyone can access a market report. That said, I decided to scan the Googleverse and see what I could find, at least on a big-picture level. (Yes, you can get more detailed and do more research than I’m about to present…but that would be a market report, and I am but one person.)

Overall

According to my research, the U.S. spinal implant market was valued at $5.1 billion in 2020. Due to the global COVID-19 pandemic, this was a 14% decrease from the 2019 market value. [6]

The global spinal implant market saw continued growth in 2019, reaching a value of $9 billion, a 3% increase compared to 2018. [8] In terms of revenue, the global spinal implants market was estimated to be worth $11.2 billion in 2023 [4] from $16.39 billion in 2022. [2]

The global spinal implants market size is expected to grow at a CAGR of:

- 5.3% from 2022-2029 [7]

- 5% to 5.59% from 2023-2028. [2,3,4]

- 5.2% by 2030 [5]

The global spinal implants market size is projected to grow by $3.57 billion from 2023 to 2028 [3], reaching:

- $14.3 billion by 2028. [3,4]

- $21.26 billion by 2028 [2] (not sure why there was a $6.96 billion difference between these references; there also seems to be inconsistency when looking at the 2022 data, so just be weary of this information as it seems like an outlier)

- $18.08 billion by 2030 [5]

Market Drivers

- Large Patient Pool: One in four people suffer from chronic back pain, creating a large patient pool.[2] Over 250,000 new SCI cases occur annually, primarily due to accidents and violence.[5]

- Aging Population: The increasing number of people suffering from spinal disorders, especially age-related conditions like disc degeneration, herniated discs, and scoliosis, is a major driver of the spinal implant market. [2,3,4,5,7]

- Obesity: The rise of lifestyle diseases like obesity is putting increasing stress on the spine, leading to more back problems and a higher demand for spinal implants. [5,7]

- Patient Knowledge: People are becoming more conscious of their health and seeking treatment sooner. [4] This growing demand pushes healthcare providers to invest in innovative surgical technologies and advanced implants, like minimally invasive surgeries (MIS) and improved implant materials, ultimately reshaping the entire sector. [2,3,4,5,7]

- Government funding supports research and innovation. [2,5]

- Improved healthcare infrastructure facilitates advanced procedures. [2,3,4]

In simpler terms, more people needing spine care means more demand for new and improved treatment options, which is good news for the spinal implant industry. [4,7]

Market Challenges

- High Costs: Surgery and implant costs are expensive, limiting patient access. [2,4]

- Limited Coverage: Some countries offer insufficient insurance coverage for these procedures. [2,7]

- Technological Limitations: Current implants have limitations, hindering wider adoption.[2]

- Knowledge Limitations: Doctors lack awareness of new implant technologies, especially minimally invasive options. Training opportunities are scarce in some regions. Patients are unaware of available implant options and their benefits. [4,7]

- Regulatory Hurdles: Stringent regulations can slow product approvals and market entry. [2,7]

- COVID-19 pandemic: Disrupted elective surgeries, impacting market growth.[5]

- Skill Shortage: There’s a lack of qualified professionals to perform these surgeries.[2]

- Competition: Alternative treatments may be chosen over implants. [2,7]

- Patient Concerns: Preference for non-surgical options, fear of side effects, and low awareness about benefits limit demand.[2]

- Product Issues: Product failures, material limitations, and ethical concerns regarding animal-derived materials deter some patients.[2]

By Technology

Non-Fusion

Non-fusion devices/motion preservation devices are implants designed to maintain flexibility. [7] Motion preservation implants are expected to dominate the spinal implant market, growing faster than other types (8.1%). [2,4,5] This is due to benefits like shorter hospital stays and faster recovery, appealing to patients and providers. [2,4,5] The growing trend towards preserving spinal motion, especially in the lower back, leads to:

- Development of dynamic stabilization systems and non-fusion technologies: These offer new implant options for doctors. [4]

- Focus on patient expectations: Procedures aim for stability and pain relief, aligning with patients’ wants. [4]

Sub-segments include TDR, posterior dynamic devices, prosthetic nuclei, and facet replacement. [5]

Fusion

Spinal fusion devices are implants used to create rigid connections between vertebrae. [7] Spinal fusion and fixation technology still hold a significant share due to its prevalence in treating common conditions like spinal stenosis and degenerative disc disease.[2] Had the largest share (58.7%-68.2%) in 2022 due to versatility, FDA approvals, and a high number of fusion surgeries. [5]

Outlook [5]

· Motion preservation technologies are gaining ground as awareness and acceptance increase.

· Advancements in both established and newer technologies will drive market evolution.

· Understanding patient needs and specific conditions will be crucial for technology selection.

By Product

The thoracic and lumbar fusion device segment, particularly anterior lumbar interbody fusion devices, will lead the spinal implant market with high growth, driven by minimally invasive surgeries, faster recovery times, and rising cases of spinal degeneration. [2,5]

Cervical fusion devices, especially anterior cervical fusion, will hold a significant share due to increasing cases of cervical disc problems. [2,5]

Spine biologics and VCF treatment devices are also expected to see healthy growth due to rising demand for bone graft substitutes and treatments for osteoporosis and vertebral fractures. [2] Vertebral Compression Fracture (VCF) devices have an anticipated growth of 6.3% due to rising spine disorders and minimally invasive surgery preference. [5]

Outlook [5]

· Minimally invasive options gaining traction across segments.

· Advancements in technology and materials will likely influence market trends.

· Geographical expansion by key players is expected to contribute to overall growth.

By Surgery Type

Minimally invasive surgery (MIS) currently dominates the spinal implant market and is expected to maintain its lead, growing at 6.8%, due to its numerous benefits: [2,5]

- Reduced blood loss, faster recovery, and fewer complications attracts patients and translates to faster market growth. [2,5]

- Better patient outcomes and less discomfort, compared to open surgery, MIS provides a more favorable experience for patients. [2,5]

- Development of sophisticated tools and techniques, such as navigation systems, ensures accuracy and further propels MIS adoption. [2,5]

Open surgery is still common for complex cases. Still, it is declining due to longer operating times, blood loss, and tissue damage risks. [2,5] The growing preference for MIS and its advantages will drive significant market expansion in the coming years.[2]

- Laminotomy: Largest share (38.1%) in 2022, most common procedure, often combined with discectomy.[5]

- Foraminotomy: Fastest growth (5.9%) expected due to:[5]

- Increasing use of minimally invasive surgery for treating pinched nerves.

- High success rates and low complication risks.

Outlook [5]

- Minimally invasive procedures likely to drive growth across all segments, especially foraminotomy.

- Technological advancements in tools and techniques may further influence trends.

- Understanding specific patient needs and conditions remains crucial for procedure selection.

By Region

Going to apologize upfront here; I wanted to focus on the US market because that is where I’m based.

North America, dominated by the US market, is expected to contribute 43%-48.8% to global market growth due to several factors: [2,3,5]

- High prevalence of spinal disorders fueling demand for treatment and implants. [2]

- Focus on technological advancements and development of improved implants attracts patients and promotes market growth. [2,5]

- Strong presence of major companies drives innovation and market leadership.[2]

- High number of accidents in the US creates a constant need for spinal care and implants. [2,5]

- Continuous investment in advanced implant development attracts more patients and procedures.[2]

- Healthcare reimbursement policies.[5]

Outlook [2]

Overall, North America’s robust healthcare infrastructure focuses on innovation and large patient population solidify its position as the leading the market for spinal implants.[2]

Key Market Players

Major companies in this market include well established and financially stable suppliers of spinal implants. Prominent companies and spinal implants market include:

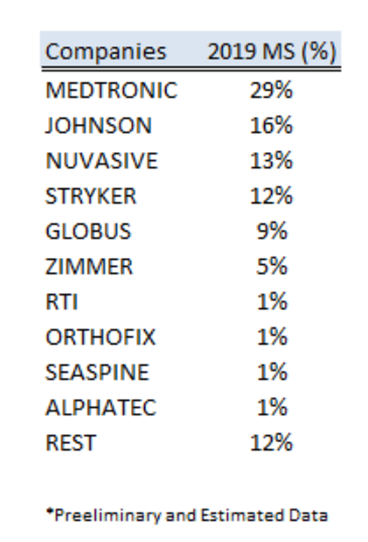

- Medtronic [2,4,5,6,7,8]

- JnJ (DePuy Synthes) [2,4,5,6,7,8]

- Stryker Corporation [2,4,5.7,8]

- Nuvasive [2,4,5,7,8]

- Globus Medical [2,4,5,7,8]

- Zimmer, Biomet [2,4,5,7]

- RTI Surgical [2,4,5,7]

- Alphatec Spine, Inc. [2,5,7]

- Orthofix Holdings, Inc. [2,5,7]

- K2M Group [2]

- Spineart [4]

- Ulrich GmbH & Co. KG [5]

- B. Braun Melsungen AG [5]

- Seaspine Holdings Corporation [5]

- SpineGuard [7]

- LDR Holding Corporation [7]

- Integra Life Sciences [7]

- B. Braun Melsungen AG [7]

Today’s Spine Market Shares (2019)

References

[1] Yahoo is part of the Yahoo family of brands. (n.d.). Published February 16, 2024. https://finance.yahoo.com/news/spinal-implants-market-expected-reach-123000875.html

[2] Ltd, M. D. F. (n.d.). Spinal Implants Market Size, Share, Growth | 2023 to 2028. Market Data Forecast. Published March 2023. https://www.marketdataforecast.com/market-reports/global-spinal-implants-market

[3] Sandberg, J., & Sandberg, J. (2023, December 4). Spinal Implants Market size to grow by USD 3.57 billion from 2023-2028, North America to account for 43% of market growth – Technavio. Ortho Spine News. https://orthospinenews.com/2023/12/04/spinal-implants-market-size-to-grow-by-usd-3-57-billion-from-2023-2028-north-america-to-account-for-43-of-market-growth-technavio/#:~:text=FinancialSpine-,Spinal%20Implants%20Market%20size%20to%20grow%20by%20USD%203.57%20billion,43%25%20of%20market%20growth%20%E2%80%93%20Technavio&text=NEW%20YORK%2C%20Dec.,billion%20from%202023%20to%202028.

[4] Spinal Implants Market Size, Share, Trends and Revenue Forecast [Latest]. (n.d.). MarketsandMarkets. https://www.marketsandmarkets.com/Market-Reports/spine-surgery-devices-market-712.html?utm_source=globenewswire&utm_medium=referral&utm_campaign=paidpr

[5] Spinal Implants and Devices Market Size, share & Trend analysis by product, by technology, by surgery type, by procedure type (Discectomy, laminotomy, foraminotomy), by region, and segment Forecasts, 2023 – 2030. (2023, May 12). https://www.grandviewresearch.com/industry-analysis/spinal-implants-spinal-devices-market?utm_source=google&utm_medium=paid_ad&utm_campaign=hc_latest&utm_term=spinal_implants_and_devices_market&gad_source=1&gclid=CjwKCAiAlcyuBhBnEiwAOGZ2S0f7ML3Kc7YY-KSCHQi-A5oXxQUFpDoTYxK2Er2nORWrhW4Yh-Cv0BoCw-4QAvD_BwE

[6] iData Research. (2022, November 3). U.S. Spinal Implants Market Size & COVID-19 Analysis | 2021-2027. https://idataresearch.com/product/spinal-implants-market-united-states/

[7] North America Spinal Implants Market Report – Industry trends and forecast to 2029 | Data Bridge Market Research. (2021, December 1). Data Bridge Market Research, https://www.databridgemarketresearch.com, All Right Reserved 2024. https://www.databridgemarketresearch.com/reports/north-america-spinal-implants-and-spinal-devices-market

[8] SPINEMarketGroup. (2021, November 26). Today´s Spine Market Shares Estimate and Full year Revenues. https://thespinemarketgroup.com/todays-spine-market-shares-and-full-year-revenues/

Image: Photo by cottonbro studio: https://www.pexels.com/photo/a-medical-imaging-examination-of-the-spine-5723878/

Leave a comment